- Events

- Articles

articles

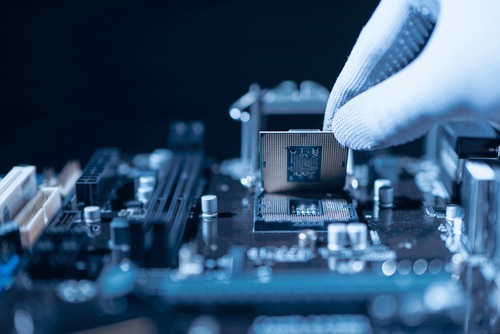

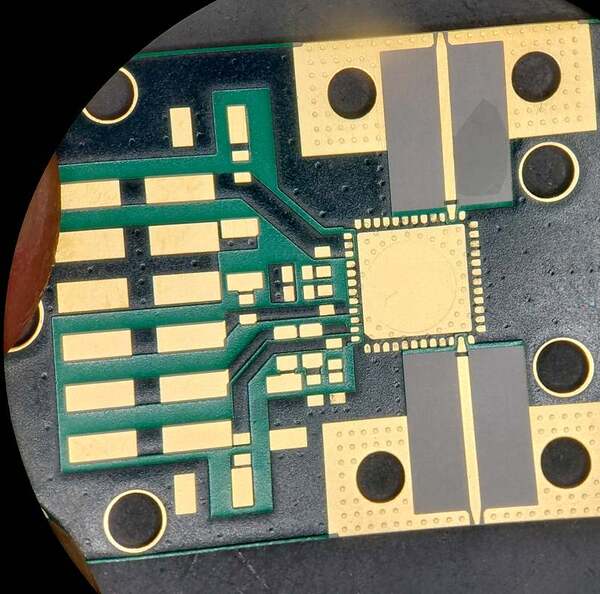

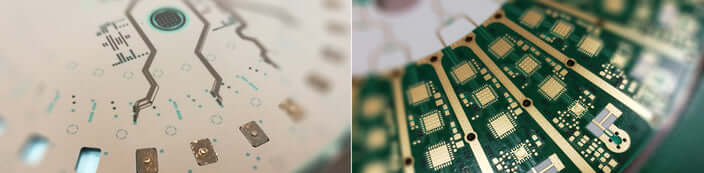

Faster, More Accurate Production of HDI PCBs

articles

Why should you use Rigid-Flex PCBs

articles

PCBs - The Critical Core Component in Medical Devices & Equipment

Learn about the Critical Core Component in Medical Devices & Equipment, by PCB Technologies.

articles

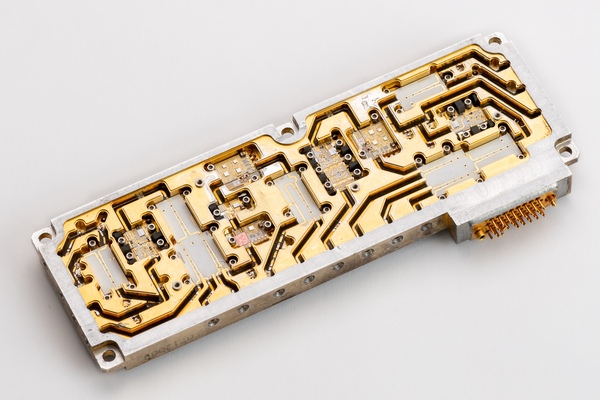

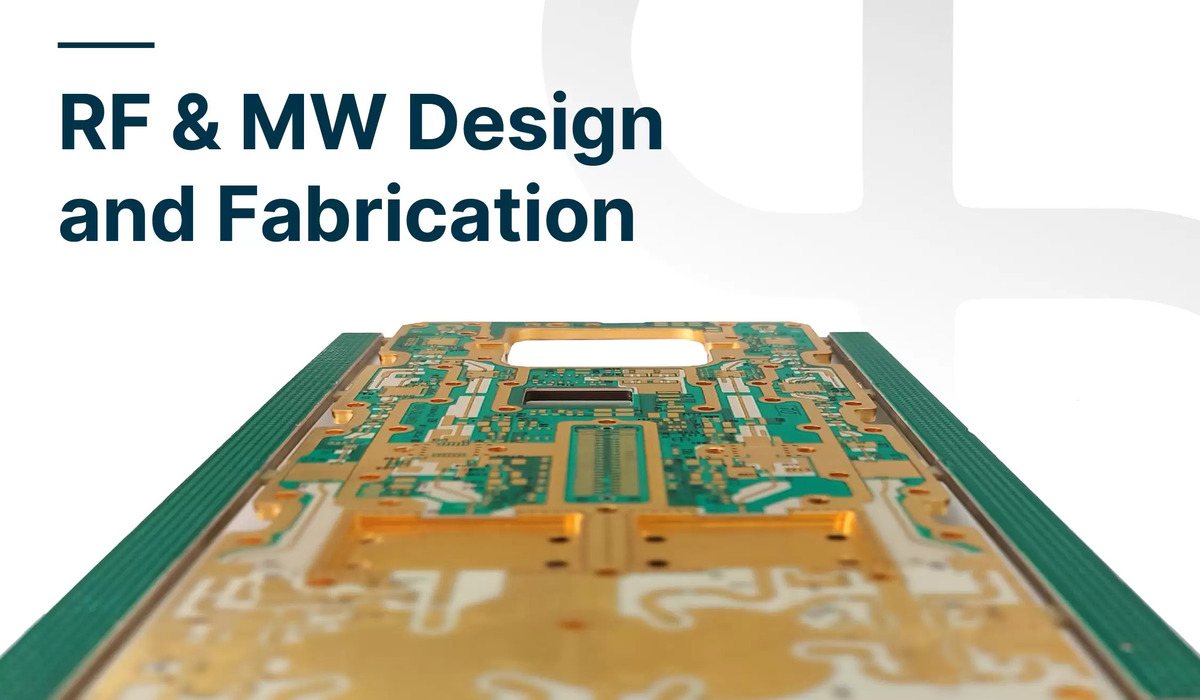

PCB Design for Radio Frequency & Microwave Module solutions

Learn about our advanced PCB design solutions offering high-performance Thermal Management options for Radio Frequency & Microwave applications.

articles

PCB Thermal Management Solutions

PCBs are the first heat management platform that electrical components meet. How you choose to handle the heat very much depends on the power dissipated from constituent components, line losses, board design, circuit editing, and mechanical structure. There are also thermal effects that arise from interconnect options on the board level, vias, transmission lines and assembly pad design.

articles

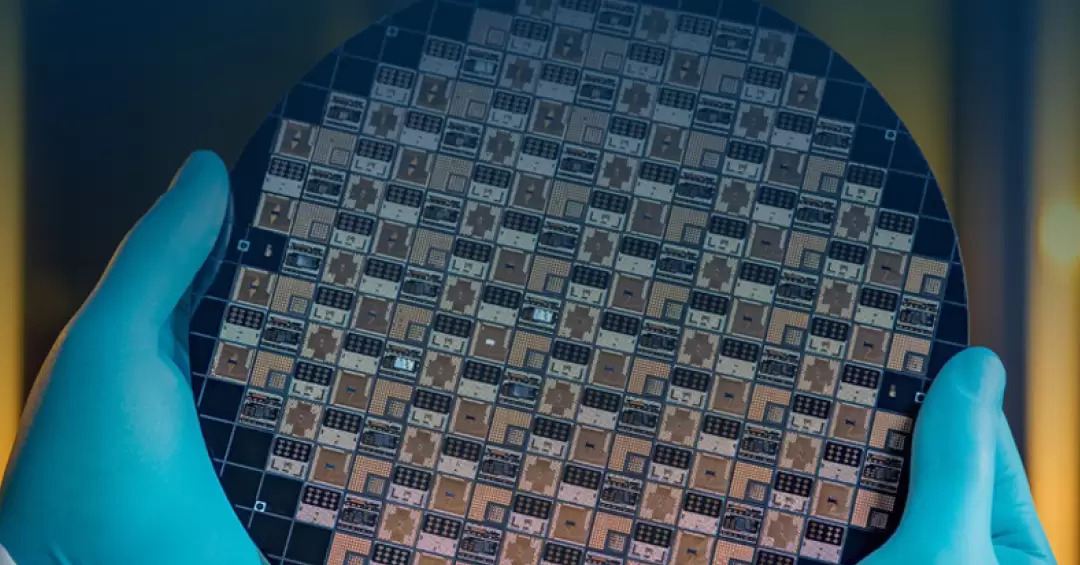

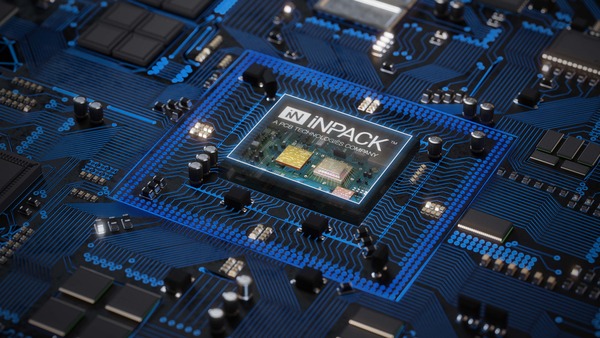

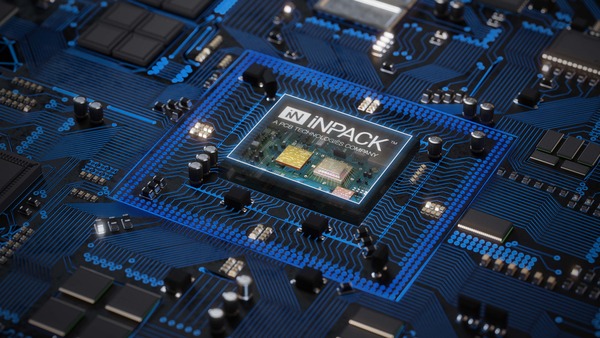

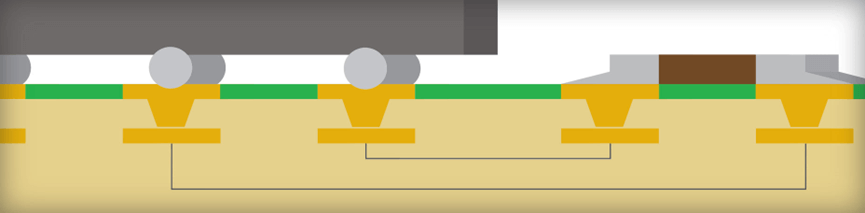

iNPACK™ Panel Level Solutions

PCB Technologies’ iNPACK Division offers complete package PCB assembly solutions for both low and high-volume requirements. This includes SiP-system in package design and manufacturing, surface mount tech, chip on board (COB), microfabrication, and substrate design and manufacturing capabilities.

articles

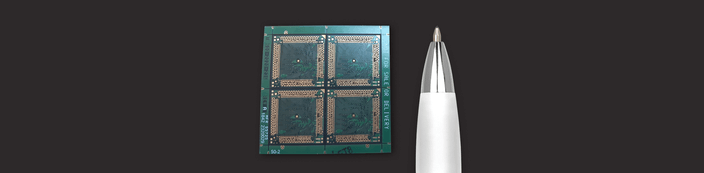

Miniaturization: The New Frontier in Aerospace

articles

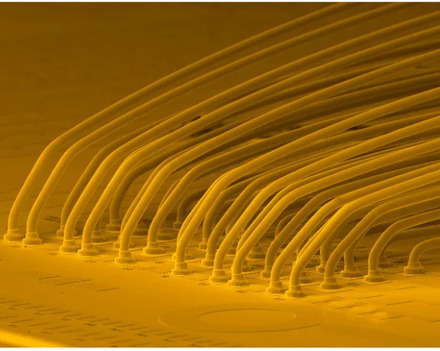

An In-depth Look at Wire Bonding Options

articles

Die Stacking Technology Where Less is Moore in PCB Design & Manufacturing

articles

SiP Reliability Analysis & Testing

articles

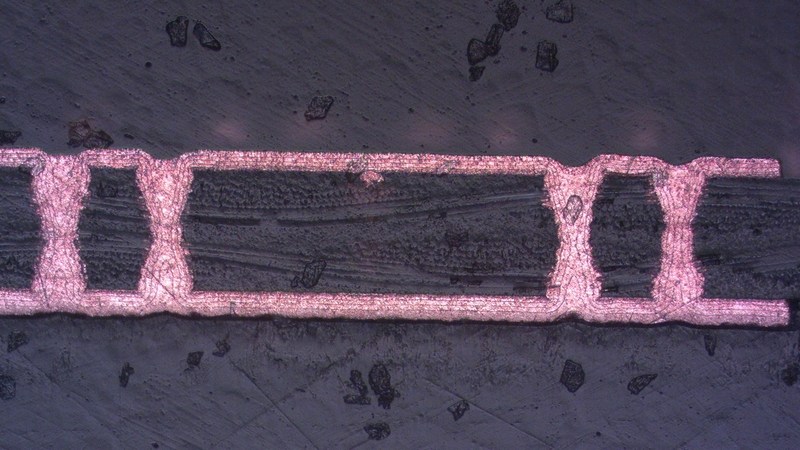

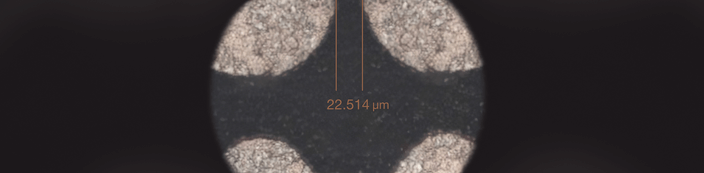

X-VIA Technology: Critical for HDI Packages

articles

The Time is Now: Antenna-In-Package (AiP) Solutions

articles

System-in-Package & Multi-chip Modules Technology

articles

Why Introduce Graphene into Advanced PCBs?

articles

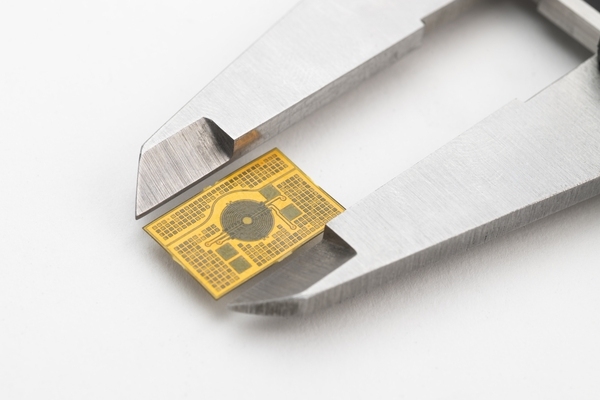

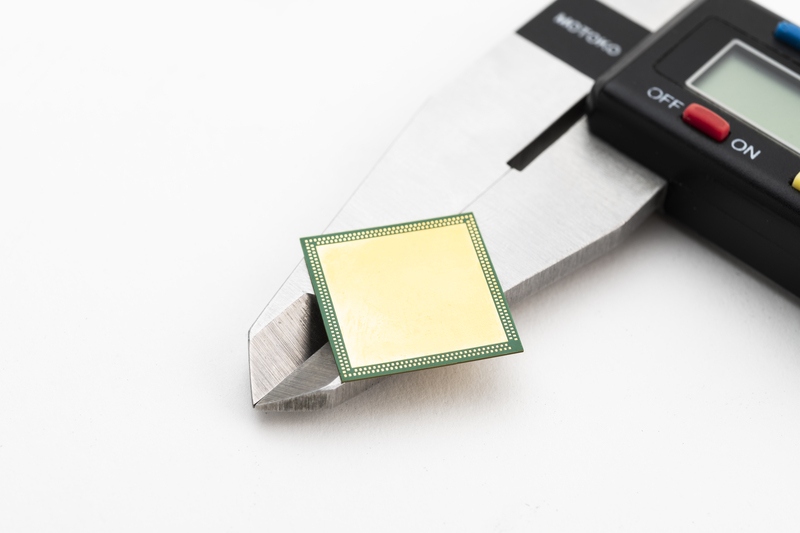

Focusing on Substrate PCB

articles

When is a Miniaturized PCBA the Right Option for You?

articles

The Complexities of Microelectronics Microwave Modules

articles

‘Moore’ than a PCB – Breakthrough Solutions

articles

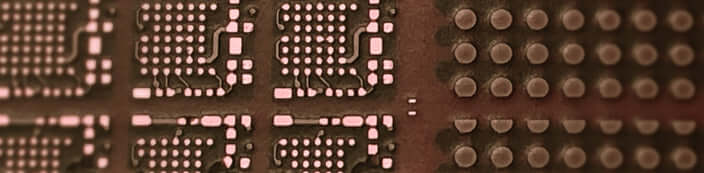

What mSAP Technology Can Do for Your Advanced Applications

articles

SLP – Substrate-Like PCB Technology

Eye-opening interview with PCB Technologies’ CTO Yaad Eliya about SLP Technology; exploring its huge growth potential and far-reaching impact on the design, fabrication and manufacturing processes of today’s hottest new products, applications, and near-future innovations.

articles

Equality woman and man

articles

Radio Frequency (RF) Heat Dissipation and Coins Technology

As technology continues to evolve, so does the demand for improved thermal management and higher RF performance for PCBs and subsystems. As applications become more complex, and SWaP constraints become a priority, the need for innovative solutions has become even more pressing. Industries such as defense, aerospace, medical, and sensor applications require these solutions to decrease in size while offering greater functionality than ever before. In this article, we will dive into the different approaches to thermal management and compare the advantages of "Coin" technology with traditional thermal via technology to see how they stack up.

events

Introducing iNPACK™ | PCB Technologies exposure conference

We have gone from a mini-manufacturer to a full-fielded development center for our customers and received valuable feedback reinforcing our company's worth.

Check out our recent customer conference video at PCB Technologies! It was a huge success, showcasing our capabilities and expertise in miniaturization, substrate production, and more. Around 200 professionals attended and the level of engagement was outstanding.

articles

Extreme heat dissipation solution in PWB stage

The challenge at hand was providing the customer with an extreme heat dissipation-resistant PCB, to be installed in an electronic device releasing a large amount of heat during its operation, thus utilizing the PCBs as a cooling system.

articles

How can you ensure your customer a QTA (Quick Turn Around)

How can you ensure your customer a QTA (Quick Turn Around)

articles

All-in-One Substrates and Advanced Packaging Solutions

How does an All-in-One solution definitely benefit the customer?

events

Visit us at IMS, 2022, Colorado Convention Center, Hall B, Booth #10090

articles

PCB Technologies Launches iNPACK, a Miniaturization, and Advanced Packaging Solution Provider

articles

Introducing Graphene into advanced printed circuit boards

articles

Our new CU fill (electroplated) machine enabling enhanced system performance

articles

Modified Semi Additive Process (mSAP) boosts High-Density Interconnect (HDI) PCB capabilities

articles

Miniaturization - special laminate materials and buried capacitors technology in the works

articles

Miniaturization technology - Controlling thermal expansion and power dissipation

articles

Supporting Semiconductors machine manufacturers

articles

Test and Inspection Management

articles

The best of both worlds

articles

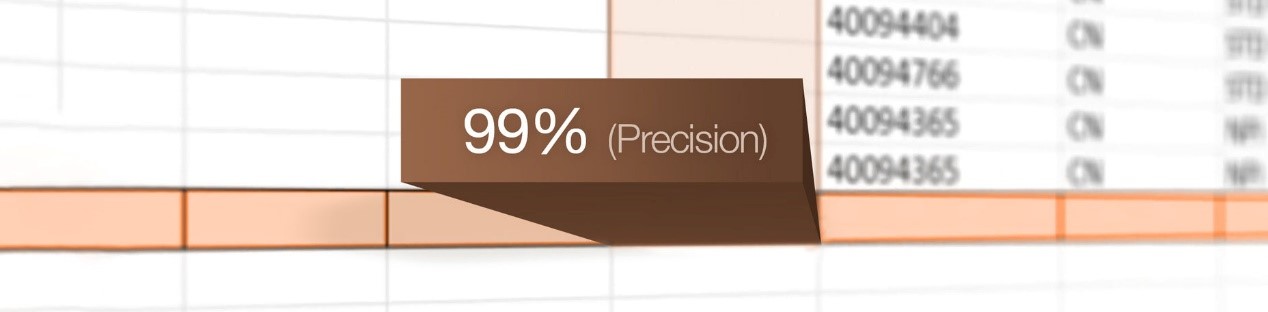

Solid data management – key to accurate quotes

articles

Innovation at its best – Packaging solutions at the COMCAS conference

articles

Enhanced capacity for precise and speedy production

articles

New miniaturization technology

articles

In-house HATS (Highly Accelerated Thermal Shock) lab- Evaluating reliability for extended survivability

articles

All-in-One – the lab inspection angle

articles

Why just dense when you can miniaturize?

events

PCB Technologies in support of the Aerospace industry

events

Coins insert – the advanced heat dissipation method for cooling electronic devices

events

All in One at all levels -repeatability, lead-time & original design v. final product

events

A new back drill technique guarantees increased depth control and tolerance

articles

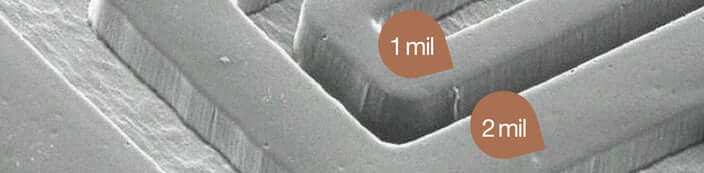

Manufacturing methods of #1-mill-line/space using subtractive processing in a HMLV industry

events

We were awarded with a large production contract of PCBs for the world's leading anti-missiles systems "Iron Dome"

events

PCB Technologies’ new miniaturization capabilities

events

Proud to be a member of the Israeli Graphene Consortium

PCB Technologies, a world leader in PCB manufacturing, was chosen as a member of the Israeli Graphene Consortium alongside with other well established industries leaders such as Mellanox, Simtal Nano Coatings and also well-known Academic institutes – Ben Gurion University, the Technion, and the University of Bar-Ilan.

events

PCB Technologies Expands Capabilities

Nolan Johnson speaks with Arik Einhorn and Yaad Eliya of Israel-based PCB Technologies about how they’ve increased their capabilities down to 1 mil line and space to better support their customers from the military, aerospace, and medical markets.

events

Designated assembly line for Elbit systems

events

Breaking the Circle: The Potential of PCB Technologies

The shares of companies in the field of electrical components traded in the United States have yielded an average return of about 10% in the past year, compared to almost 50% in the NASDAQ index. The stock of the printed circuit board manufacturer, which is controlled by the FIMI Fund, is currently trading at an interesting price

events

PCB Technologies producing 1 mil lines space PCBs

events

PCB Technologies Focuses on an All-in-One Solution

An interview conducted with Arik Einhorn on IConnect007 to find out about the All-in-One capabilities that PCB Technologies has to offer from higher-complexity PCB with the scalability to handle prototyping all the way through mass production if needed.

events